Digital Trends to Watch in 2019

As we close out the “teens” decade and prepare for the Roaring Twenties, the media landscape remains as complicated as ever. That cat-and-mouse game between marketers (who seek to sell their wares to consumers) and consumers (who seek to limit or control the marketing messages they receive) has elevated to new levels. It is so easy to be overwhelmed by everything new that comes our way. We seek to separate the shiny objects from the trends that will make a real difference in how consumers and marketers interact in the coming years. With that in mind, we present Harmelin Media’s Digital Trends to Watch in 2019 – seven developments that you should pay attention to now, or risk playing catch-up down the road.

As we close out the “teens” decade and prepare for the Roaring Twenties, the media landscape remains as complicated as ever. That cat-and-mouse game between marketers (who seek to sell their wares to consumers) and consumers (who seek to limit or control the marketing messages they receive) has elevated to new levels. It is so easy to be overwhelmed by everything new that comes our way. We seek to separate the shiny objects from the trends that will make a real difference in how consumers and marketers interact in the coming years. With that in mind, we present Harmelin Media’s Digital Trends to Watch in 2019 – seven developments that you should pay attention to now, or risk playing catch-up down the road.

1.) Vertical Video Will Explode

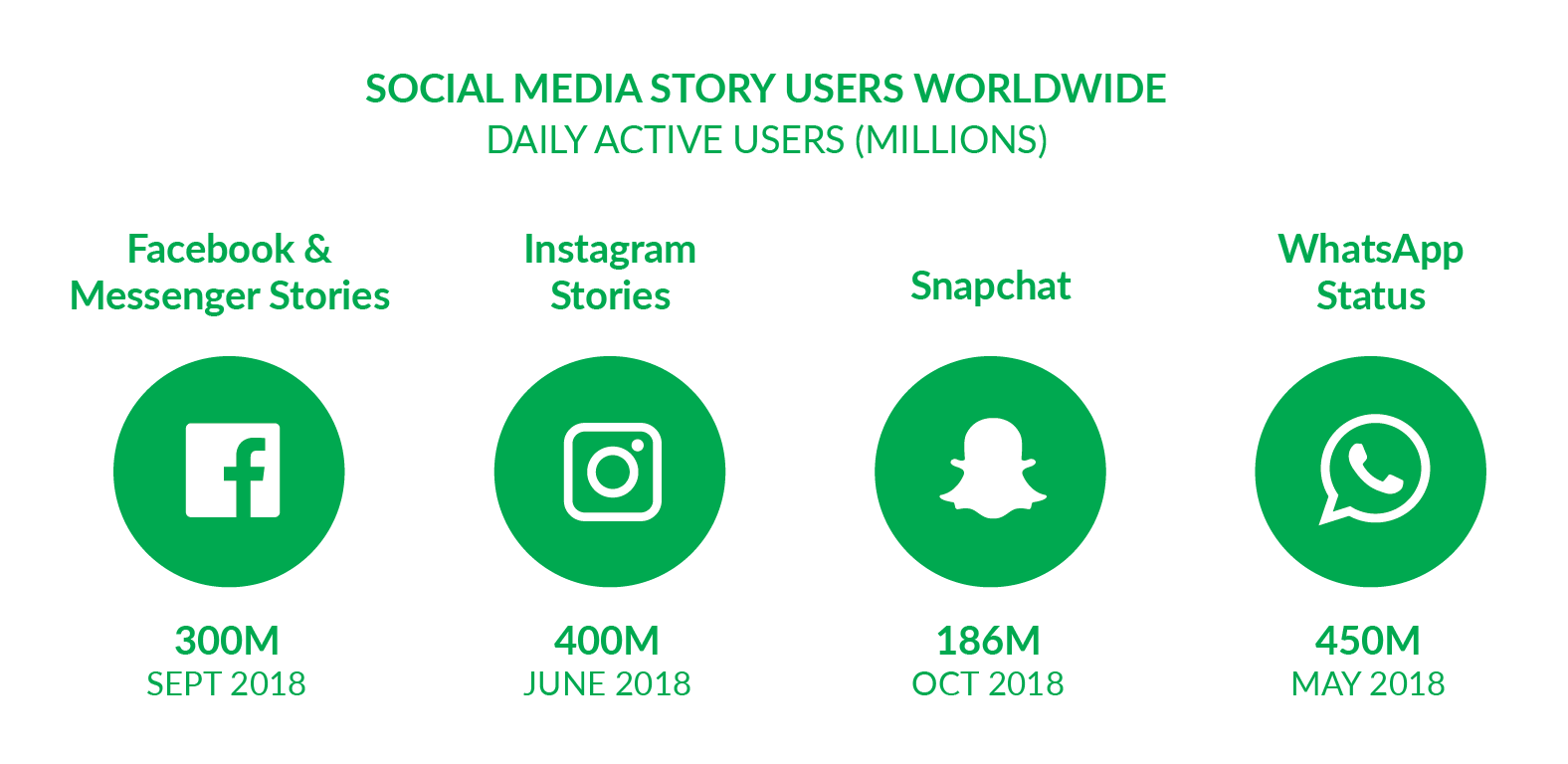

Vertical video ads, which were first seen on mobile-only Snapchat Stories in 2014, have now made their way to all the major social and digital platforms including Facebook Stories and Newsfeed, Instagram Stories, Pinterest, YouTube, and Spotify.

Vertical video presents advertisers with the opportunity to have more control over onscreen real estate. Advertisers can now deliver ads at scale that appear native on the platforms and devices on which they are viewed. The ability to fill a mobile screen in between the content that users are actively choosing to view presents a unique and immersive ad experience that was not previously available.

Vertical video also presents challenges in producing highly engaging content suitable for Stories placements. While repurposing a standard, horizontal TV spot into digital is never recommended, vertical video placements eliminate that possibility entirely. To combat this, Facebook has created MobileWorks, a program that turns TV assets into mobile optimized content.

So, why all the fuss about vertical video? Because it is becoming a necessity in any media mix. The vertical video Stories placement on Facebook-owned Instagram is the fastest growing product and placement in Facebook’s history. They have just enabled the Stories placement on Facebook and Messenger Stories as well. Vertical videos typically see a 90% higher completion rate versus horizontal videos, and 79% of vertical video consumers agree that the format is more engaging than horizontal video.

The challenges in creating engaging vertical video content are worth overcoming. CPMs are low for vertical video ads because adoption rate thus far has been low. The vertical video trend only continues to grow in popularity and value, creating more premium inventory on social platforms and other publishers at low rates.

2.) Amazon Becomes a One-Stop Shop, Literally

The digital advertising industry moves fast. To highlight how fast, let’s revisit our “Digital Trends to Watch in 2017” where we wrote about the growing duopoly of Facebook and Google. In that paper we stated that “Google and Facebook take over 55% of all U.S. dollars spent on digital advertising.”

The digital advertising industry moves fast. To highlight how fast, let’s revisit our “Digital Trends to Watch in 2017” where we wrote about the growing duopoly of Facebook and Google. In that paper we stated that “Google and Facebook take over 55% of all U.S. dollars spent on digital advertising.”

Per eMarketer, in 2018 the duopoly will grow to 57.7% of all U.S. dollars spent on digital advertising, but by 2020, that figure will drop to 55.9%. The challenger? Amazon, which is projected to capture 7% of all U.S. digital ad spending by 2020.

Amazon’s threat to the duopoly is legitimate and is driven by their wealth of consumer data and their position as the largest online retailer, placing ads closer to the point of sale than anyone else can with unmatched scale. Amazon not only offers highly-targeted display and video ads driven by consumer purchase signals on their owned and operated sites, but on third-party sites via their demand side platform (DSP) as well. They also offer search ads, which show in the results of product searches.

Amazon has many advertising growth opportunities, from running ads on Prime Video (much like Hulu), to allowing sponsored content on their Alexa devices (specifically the Echo Show), to developing an ad network for creators to monetize their “Skills.”

For retail advertisers and those who sell on Amazon, having a distinct Amazon strategy is a must. Harmelin Media recognized this trend years ago and has devoted significant resources to strengthening our relationship with Amazon. We are a preferred agency partner and have built an internal team of Amazon experts to leverage all of Amazon’s ad tactics with maximum effectiveness. Amazon is a fully integrated platform that requires an understanding of not only paid media, but also on-platform SEO, product page management, and inventory analysis. Amazon truly requires end-to-end management to be successful.

3.) Programmatic Continues to Evolve

The current state of advertising technology is a messy one. The most recent 2018 LUMAscape shows the complexity of the digital advertising ecosystem. From agencies to ad servers, the LUMAscape contains hundreds of company logos. Most are ad tech companies.

Over the past several years, we’ve seen many ad tech firms either exit the ecosystem, merge, or get acquired by other ad tech companies. We’ve recently seen companies like Yahoo, AOL, TubeMogul, Turn, and Datalogix acquired by companies such as Verizon, Adobe, and Oracle. It is likely that consolidation and acquisition of ad tech companies will continue.

DeskOne has fully vetted all major platforms and ad tech partners to develop full-stack solutions that allow our clients to accelerate marketing efforts and performance. While some ad tech companies exist in order to help solve a niche problem for some marketers, ultimately these companies will likely be acquired by one of the big players in ad tech – Google, The Trade Desk, Facebook, Amazon, Adobe. In 2019, Harmelin’s trading desk, DeskOne, will also consolidate programmatic media buying efforts to the industry’s premier, enterprise platforms.

What does a full ad tech stack solution look like to DeskOne? It is comprised of four main components: An identity graph, data integration capabilities for 1st, 2nd, and 3rd party data, omnichannel buying capabilities, and cross-channel buying synergies. These four components allow DeskOne to buy data-driven media across all channels and all screens programmatically including display, video, CTV, and audio. In other words, the same data set can be used cross-channel to target the same individual regardless of where they are consuming media. In some cases, data can be shared from channel to channel when utilizing an integrated tech stack. For example, by leveraging Google’s tech stack, DeskOne can ingest click data from a client’s paid search campaign to build retargeting and lookalike segments for display.

With advancements being made in digital out-of-home, terrestrial radio, and linear television, data-driven programmatic buying across these historically analog channels is closer to being reality than not. Therefore, it is imperative to understand not only the current client needs, but also future needs when analyzing various ad tech platforms. Understanding our clients’ future needs is a big driver of ensuring DeskOne aligns with best-in-class ad tech solutions. It is more valuable for our clients to run campaigns through an integrated tech stack versus each channel running on a separate platform. Think of DeskOne as a restaurant – you can get your meal all in one place rather than buying your salad at one spot, your entrée at another, and your dessert at a third place. By buying all three meal items in one place, you save time and get a better deal. Consolidation means more buying power for our clients.

Ad tech and digital advertising will continue to be a complex space for years to come, and there does not seem to be any slowdown in innovation. But one thing is for sure, consolidation of ad tech will continue until the space is boiled down to just a handful of players.

4.) Identity Marketing Becomes Table Stakes

For decades, advertising has been purchased using broad demographic segments with little understanding of how each individual user may be impacted by the message. As we head into 2019, it’s now possible to deliver precisely targeted messaging to customers based on insights through 1st, 2nd, and 3rd party data sets. This enables our advertising to be more personalized and relevant than ever before.

Identity-based advertising and identity graphs have recently been a topic of major discussion in the industry. This approach is ultimately a transition from mass marketing to messages being delivered on a one-to-one basis. As more media channels become addressable, identity-based marketing will continue moving to the forefront of media plans. With the help of data onboarding products, an advertiser’s offline data can be matched to online cookies and device IDs in a compliant and privacy-safe fashion.

These consumer segments can then be ported to several different activation or data-housing platforms. Data onboarding gives advertisers the power to segment audiences and messaging based on what they know about their customer. Advertisers can also use this data to negatively target – to suppress messaging to audiences who would not find a certain campaign meaningful to them, based on where they are within the product lifecycle.

Beneficial to this process is the use of Data Management Platforms (DMPs). DMPs allow brands to connect data from website visitation, paid media exposure, email marketing, 3rd party data segments, and more into one centralized repository. They allow marketers to collect, organize and activate custom audience segments to create messaging journeys and power brand storytelling.

Beneficial to this process is the use of Data Management Platforms (DMPs). DMPs allow brands to connect data from website visitation, paid media exposure, email marketing, 3rd party data segments, and more into one centralized repository. They allow marketers to collect, organize and activate custom audience segments to create messaging journeys and power brand storytelling.

Another important piece of identity advertising is ensuring that marketers are taking a person-based approach versus a device-level approach, recognizing that almost all consumers use multiple internet-connected devices. This can be accomplished by layering deterministic or probabilistic device graphs on top of media buys to manage message frequency across a user’s multiple touchpoints and power cross-device digital attribution.

DMPs and identity marketing can not only help inform how and when we deliver our paid media to a certain individual, but also help with the creative decisioning process. By connecting DMPs to a dynamic creative optimizer (DCO), the creative itself can dynamically change on a micro-level based on a user’s attributes.

Much like the advertising technology ecosystem, there are some early winners in the identity marketing space. Facebook may very well have the largest identity and device graph but does not share its data outside of its own walled garden. Google is also in the process of building out a robust identity and device graph to power their tech stack across display, search, video, and top-level attribution. The common thread of these two companies is their scale, their registration data, and their refusal to share the actual data outside of their own platforms. Another winner emerging in the identity space is Amazon. Amazon is not only growing their share of overall dollars spent in digital advertising, but like Google and Facebook, are doing so on the backs of their scale and registration data. In 2018, Amazon began testing their Beta Attribution product – a way to tag various digital media channels to understand how those channels drive sales directly on Amazon across various devices. Like all attribution products, there are of course some flaws, with the main ones being limited tagging capabilities on platforms like Facebook, Instagram, Pinterest, and YouTube.

In order to have a better understanding of their customer’s journey across multiple touchpoints and devices, we will likely see brands and agencies expand their partnerships with companies that provide identity and device graphs. In doing so, brands and agencies will see efficiencies in their media spend by making sure a given user is not overexposed to messaging and is also receiving the proper messaging.

5.) Podcasts Will Become Addressable and Scalable

eMarketer projects that in 2019, 76.8 million people, or 23% of the U.S. population, will listen to a podcast via direct download or live stream at least once per month. Additionally, 37.4% of digital audio listeners are projected to listen to podcasts in 2019, ranking above both Pandora (36.8%) and Spotify (31.9%). There is a dramatic shift in how podcast listeners consume audio. Podcast listeners dedicate 33% of their total audio listening time to podcasts and only listen to AM/FM radio 25% of the time.

eMarketer projects that in 2019, 76.8 million people, or 23% of the U.S. population, will listen to a podcast via direct download or live stream at least once per month. Additionally, 37.4% of digital audio listeners are projected to listen to podcasts in 2019, ranking above both Pandora (36.8%) and Spotify (31.9%). There is a dramatic shift in how podcast listeners consume audio. Podcast listeners dedicate 33% of their total audio listening time to podcasts and only listen to AM/FM radio 25% of the time.

Podcast listeners are a different breed. They are a captive and invested audience. 87% say they listen to most or the entire podcast episode when listening. 48% listen at home, while 26% do so in their vehicle. Podcast listeners also tend to be a younger and more affluent audience. 34% of podcast listeners are 18-34 years old, and 51% have a household income of $75k or more. Podcast listeners are also more likely to subscribe to Netflix or Amazon Prime, meaning they are less likely to be exposed to TV advertising.

Podcasts still very much function as a niche content alignment and part of a broader audio strategy versus an audience-targeted channel. There is very limited addressability and customization within podcast advertising. For example, a national automotive brand may want to partner with NPR’s Car Talk podcast, but it might not make sense for that same brand to advertise on the “The Feed,” a podcast which focuses on food.

The technology and infrastructure for scale and addressability to target specific audiences is being built out and it’s likely that in 2019, brands will be able to more granularly target consumers listening to podcasts. In other words, consumers in-market for a mattress might be delivered an audio ad from a mattress company while listening to a podcast, regardless of the content of that podcast.

One of the first steps to addressability is the capacity to purchase programmatically. Harmelin’s trading desk, DeskOne, is working with platforms that have the infrastructure to purchase podcast and streaming audio ads in the same fashion as other digital channels. While some believe that scale and addressability in podcast advertising may lessen its effectiveness, the industry continues to grow and makes hard-to-reach and niche audiences more accessible – audiences that may not be consuming a lot of TV, audiences that don’t overlap a lot with terrestrial radio, and audiences that are more likely to use internet ad blockers.

Advertising on podcasts can be complicated. Most podcast advertising is sold at the national level. This is because the most effective use of podcast ads, where the highest amount of brand lift and consumer action is seen, is when the podcast host speaks directly about the product or brand being advertised.

There are opportunities for regional brands to advertise on podcasts, however. Regional brands can partner with local podcasts in order to achieve the live-read feel with the host. For example, a brand in the Philadelphia region could partner with Krukcast hosted by former Phillies player John Kruk. However, podcasts can be listened to and downloaded from anywhere, so brands may reach consumers outside of their footprint. Scale is also an issue with regional podcasts.

Currently, there are some podcast networks that can dynamically insert geo-targeted audio ads into podcasts, another step on the road to addressability. The dynamically inserted audio ads are pre-recorded audio spots and act more as a standard radio ad versus an organic sponsorship or integration, which arguably, is why podcast advertising is so effective to begin with. The only question is, how will podcast listeners respond to less-organic sounding audio ads?

6.) The Impact of GDPR on Data Security and Privacy

The General Data Protection Regulation (GDPR) is a series of laws that came into effect on May 25th, 2018 within the European Union. GDPR laws protect the end consumer by regulating the collection, processing, and transmission of personal data. This law identifies personal data as any information that could be used to identify a person including, but not limited to, name, email address, phone number, location data, mobile device ID, or IP address. Additionally, GDPR provides EU citizens the right to ask companies how their personal data is collected and stored, how it’s being used, and request that personal data be deleted.

The General Data Protection Regulation (GDPR) is a series of laws that came into effect on May 25th, 2018 within the European Union. GDPR laws protect the end consumer by regulating the collection, processing, and transmission of personal data. This law identifies personal data as any information that could be used to identify a person including, but not limited to, name, email address, phone number, location data, mobile device ID, or IP address. Additionally, GDPR provides EU citizens the right to ask companies how their personal data is collected and stored, how it’s being used, and request that personal data be deleted.

Currently, there are not any federal (U.S.) laws similar to GDPR, but certain states are starting to discuss and enact laws. California is the first state to enact legislation that mirrors components of the GDPR ruling. Coming into effect in 2020, the Consumer Data Protection Act allows consumers to control how and where their data is being sold with the option to opt-out entirely. This law carries a $7,500 fine and is being seen as the starting point for state-level regulation of GDPR-type protections.

Outside of California, states are exploring best practices around data security and privacy, especially in the wake of serious data breaches from Google, Facebook/Cambridge Analytica, Equifax, LinkedIn, Yahoo, and Ticketmaster. These breaches are not all related to advertising but impact the long-term domestic enforcement of data security and privacy. As of March 2018, all 50 states (and U.S. territories) have enacted data breach notification regulations that require companies to notify consumers that their personal data has been compromised.

For purely domestic campaigns, GDPR does not directly impact the way we develop creative media solutions for our clients, but it does require that we engage in transparency conversations with our inventory and data counterparts on behalf of our clients. For any company doing business overseas, it is extremely important to make sure all data that is captured on a specific target audience on-site or in-campaign (cookies, lead forms, specific site actions, etc.) is being housed and activated upon within the guidelines of GDPR. All advertisers that do business within the EU need to notify site visitors that they are collecting cookies and give the option to opt-out of the practice and be able to prove that any personally identifiable information (PII) can be permanently deleted. Any vendor that is leveraging targeting that is based upon user experiences needs to communicate their compliance throughout the planning process and state it in any official contracts.

We recommend that any multi-national organization that does business within the European Union should reach out to their legal teams to fully understand the permissible uses of data capturing and data storage through the lens of advertising. An extremely large fine (up to 2% of global revenue) could be levied against advertisers that are found in violation of these regulations.

The agency/vendor relationship is becoming more complex, but the quality of advertising and targeting will ultimately benefit the consumer. The spirit of this agreement between businesses and regulatory bodies is to have a more responsible method of engaging with a brand’s consumer in the most ethical way possible. As cookies and other historically effective mechanism of tracking and targeting are changing, there are global implications on the types of digital advertising that are used. For instance, influencer marketing or more guerrilla creative solutions that authentically speak to audiences without heavy targeting may continue to gain a larger share of global advertising dollars. Regulations like GDPR will ultimately open the door for more innovation and ethically sound consumer engagement and reengagement.

7.) The Era of Voice

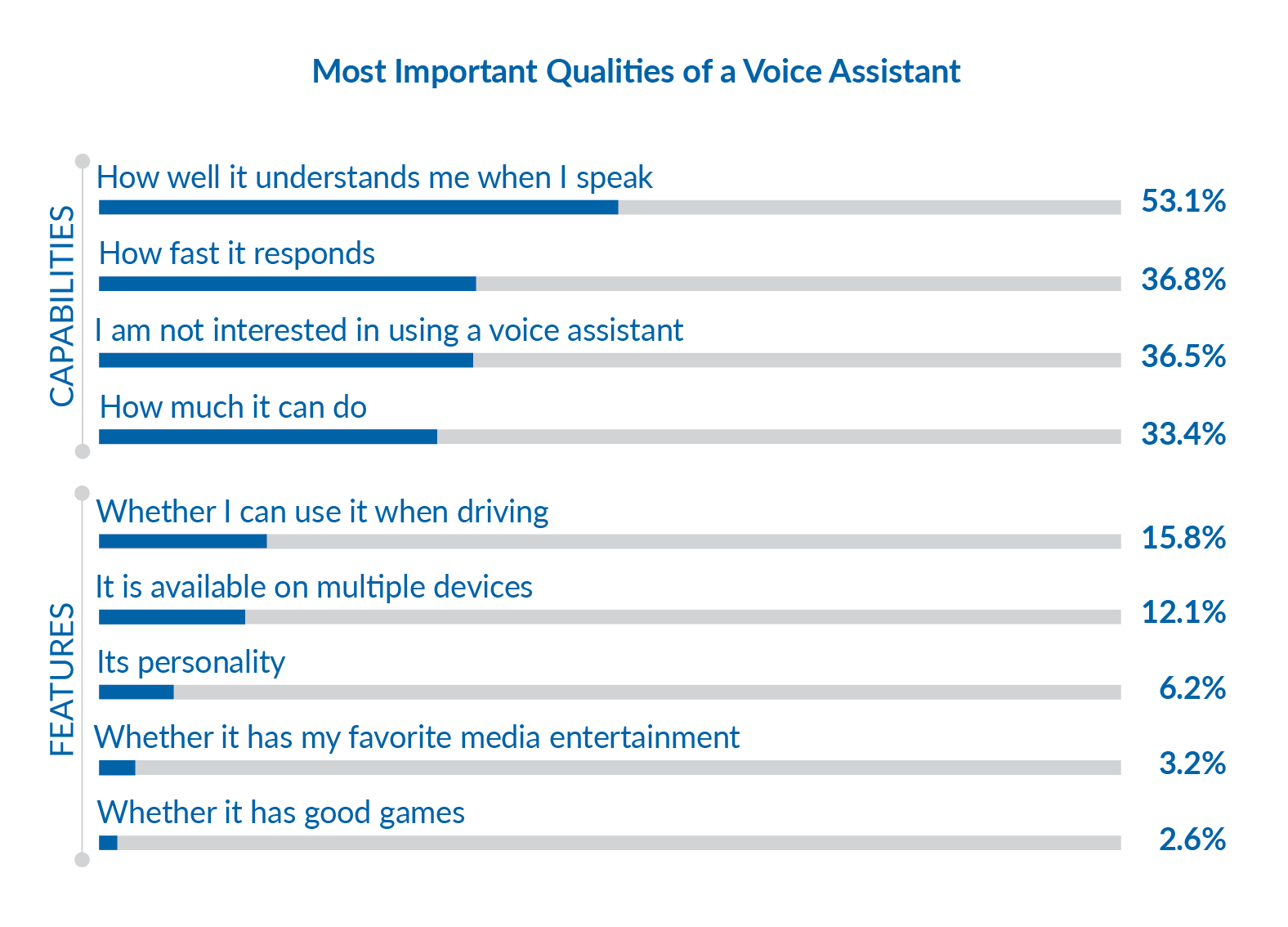

57.8 million U.S. adults currently own at least one smart speaker, representing 23% of total adult population. There has been a 22% growth in smart speaker ownership since January of 2018. Growth is expected to continue and will explode now that we are post-holiday season – unless everyone already got an Amazon Alexa or a Google Assistant as a gift??

So that begs the question – has the voice revolution already begun? If you ask the average consumer, they would likely say yes, as according to Google, 72% of smart speaker owners say they use their devices as part of their daily routine. However, most marketers have no plans for voice in the next year.

In the next few years, a brand’s presence within voice will be just as important as having a website and robust social media presence. But having a presence in voice can mean numerous things. For brands, the most important areas to pay attention to when it comes to voice are:

- Voice Search: Brands must ensure they have a firm grasp on their local content via Google My Business. SEO and content creation for voice are also extremely important.

- Skills and Actions: All brands desire to be positioned as an authority within their industry. It’s very possible that “Skills for Alexa” and “Actions for Google” become the next hub for authority much like YouTube is for video. Discoverability of “Skills” and “Actions” is still rudimentary but could soon turn into more of a curated marketplace much like the Apple App Store and drive brand loyalty. In the meantime, a brand can drive discoverability of their Alexa skill or Google action via paid media.

- Prepare for Ads: At some point soon, look for Amazon, Google, and Facebook to monetize their voice-enabled devices in a scalable way. This will likely take shape in the form of audio ads, much like streaming audio or podcasts, which are dynamically inserted into “Skills” and “Actions.” We’ll also likely see the opportunity for user-initiated sponsored content or videos as devices like the Echo Show or Google Home Hub cycle through headlines on its home screen. There will likely be restrictions around the content and videos, as they will need to feel more organic and not be a standard 30-second ad.

Voice is still very much the wild west. Tech companies are still figuring out how to move forward with voice while advertisers patiently wait in the wings. And Facebook does seem committed to hardware; shortly after the release of its Portal devices, Facebook confirmed they are working on augmented reality glasses which might be built with the same underlying software as its Oculus Rift headsets. Companies like Magic Leap, Thalmic Labs, Google, Apple, and Microsoft are also working on AR devices as well. Will these companies build voice integration into these devices? With tech companies pushing more into hardware, is this a sign that voice is only a passing fad? Or is it a signal for how far voice can extend?